Cbse Papers Questions Answers Mcq Class 12 Accountancy Basics Of Partnership Short Questions And Answers Cbsenotes Eduvictors

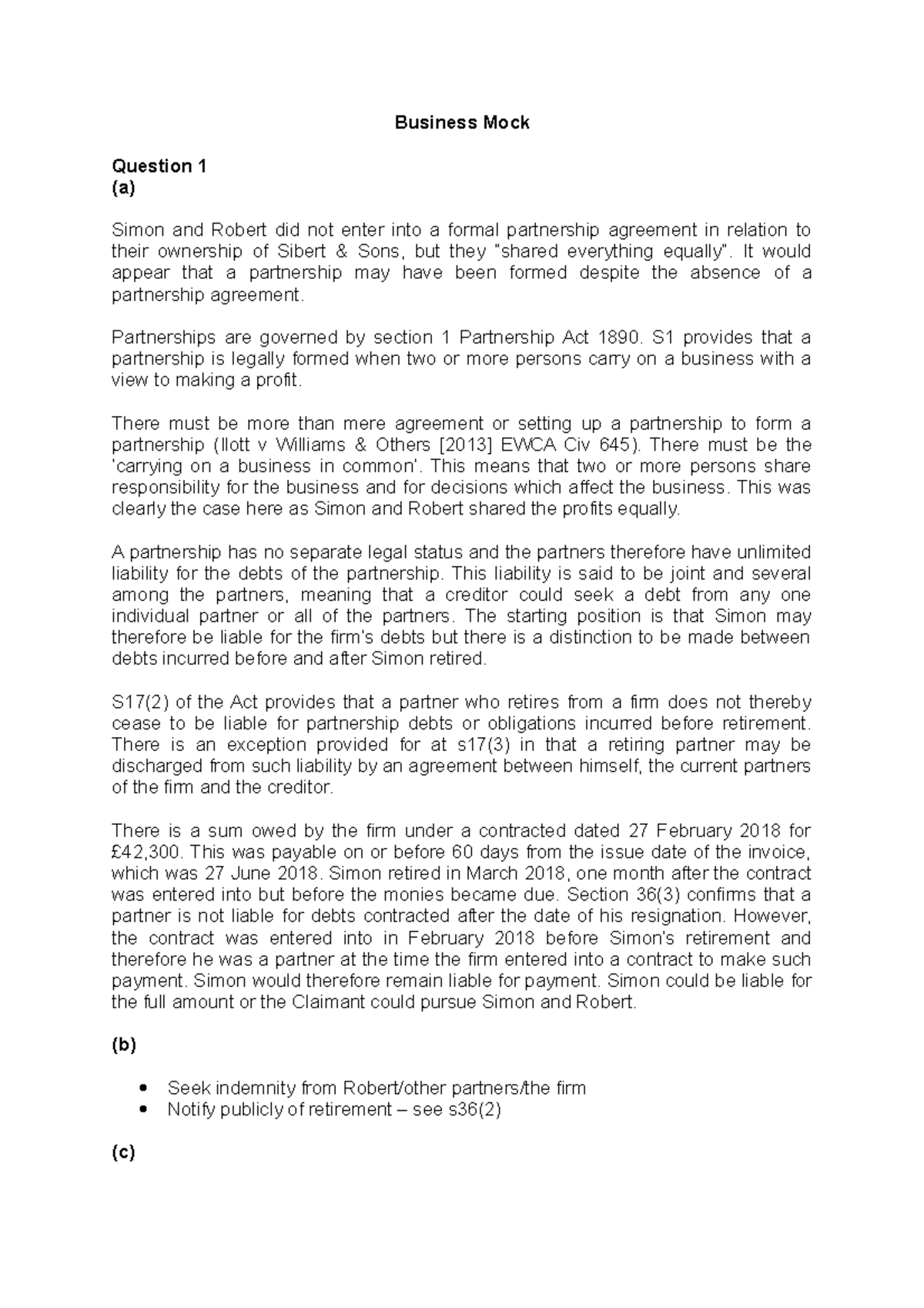

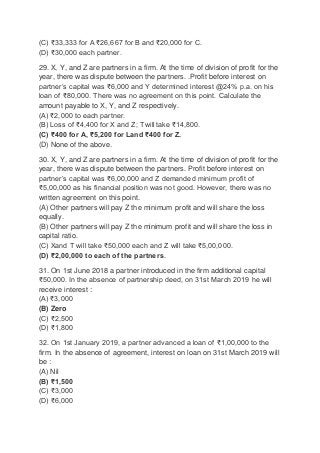

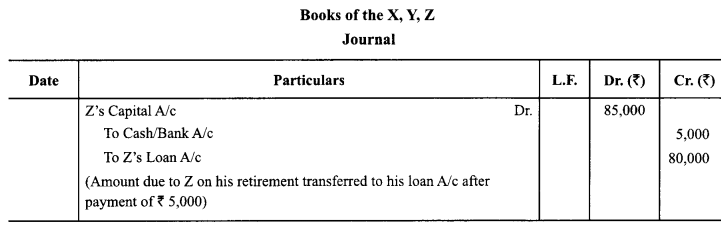

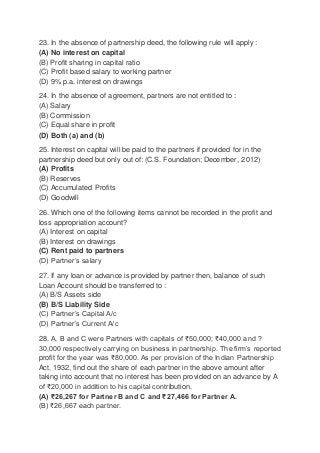

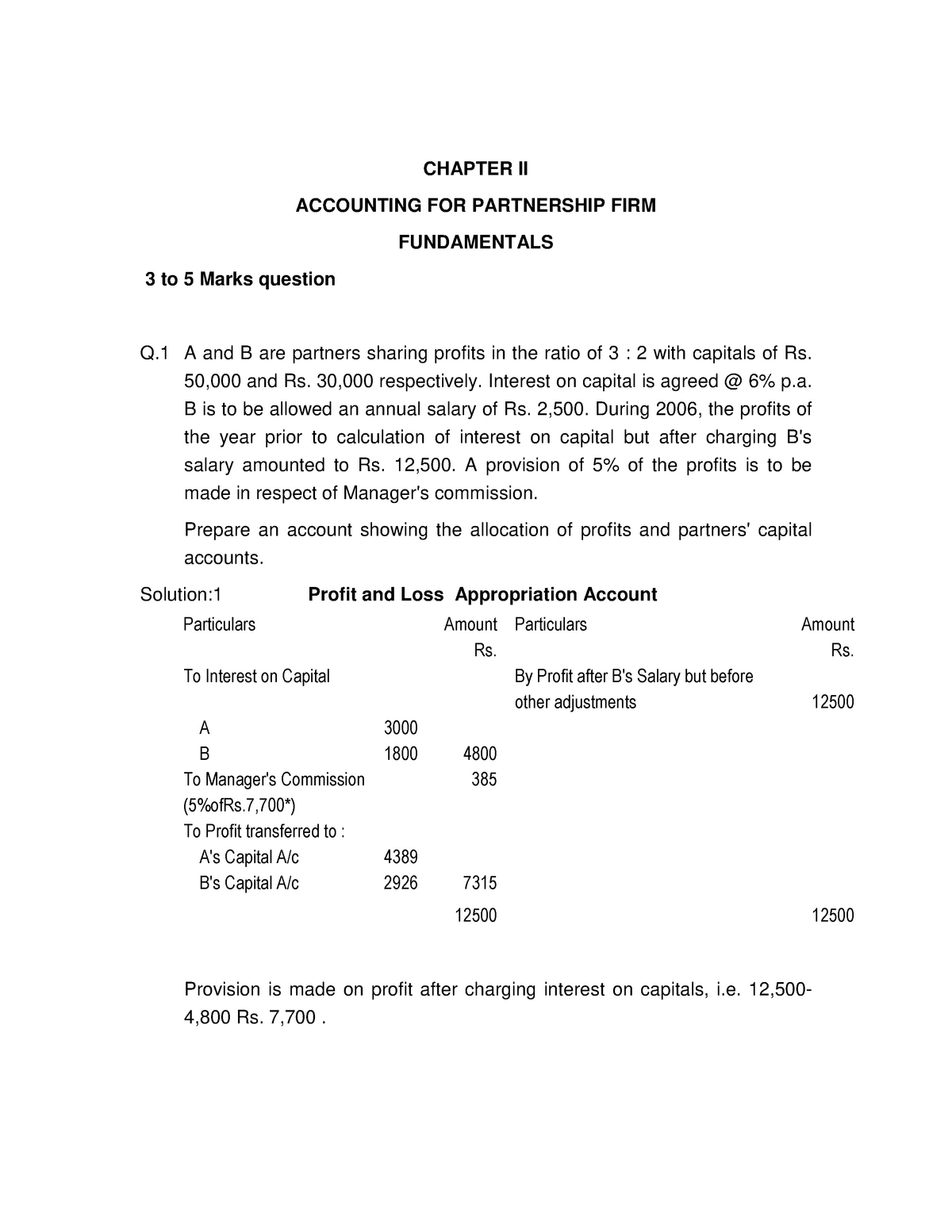

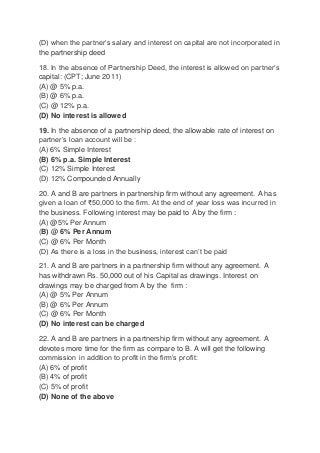

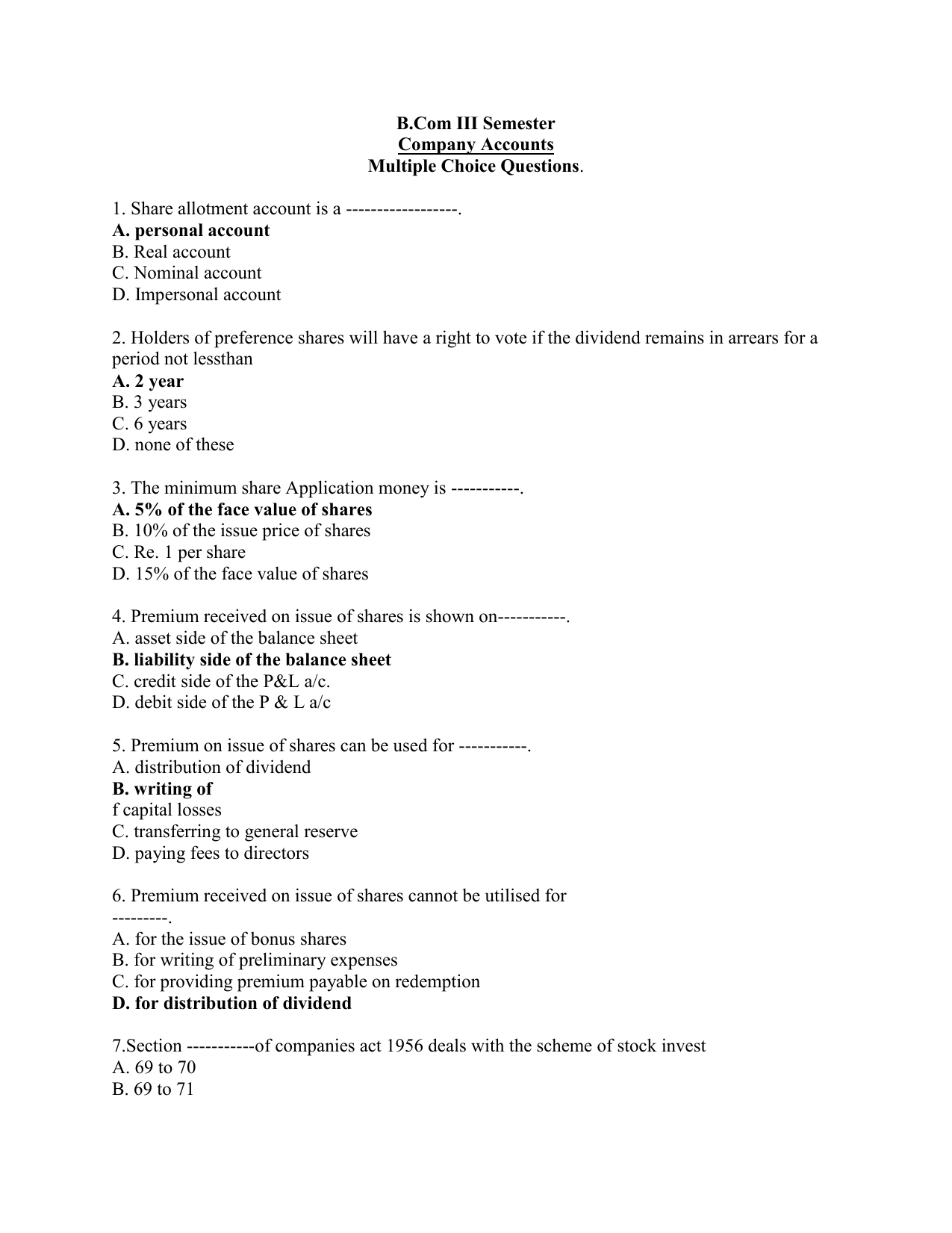

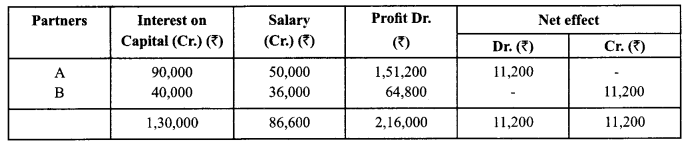

In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm (a) @5% (b) @6% (c) @ 9% (d) @8% Answer Answer (b) @6% Their fixed capitals were A ₹ 9,00,000 and B ₹ 4,00,000 The partnership deed provided the following (i) Interest on capital @ 10% pa (ii) A's salary ₹ 50,000 per year and B's salary ₹ 3,000 per month Profit for the year ended 31st March 19 ₹ 2,78,000 was distributed without providing for interest on capital and partner's

In the absence of partnership deed interest on loan of a partner is allowed mcq

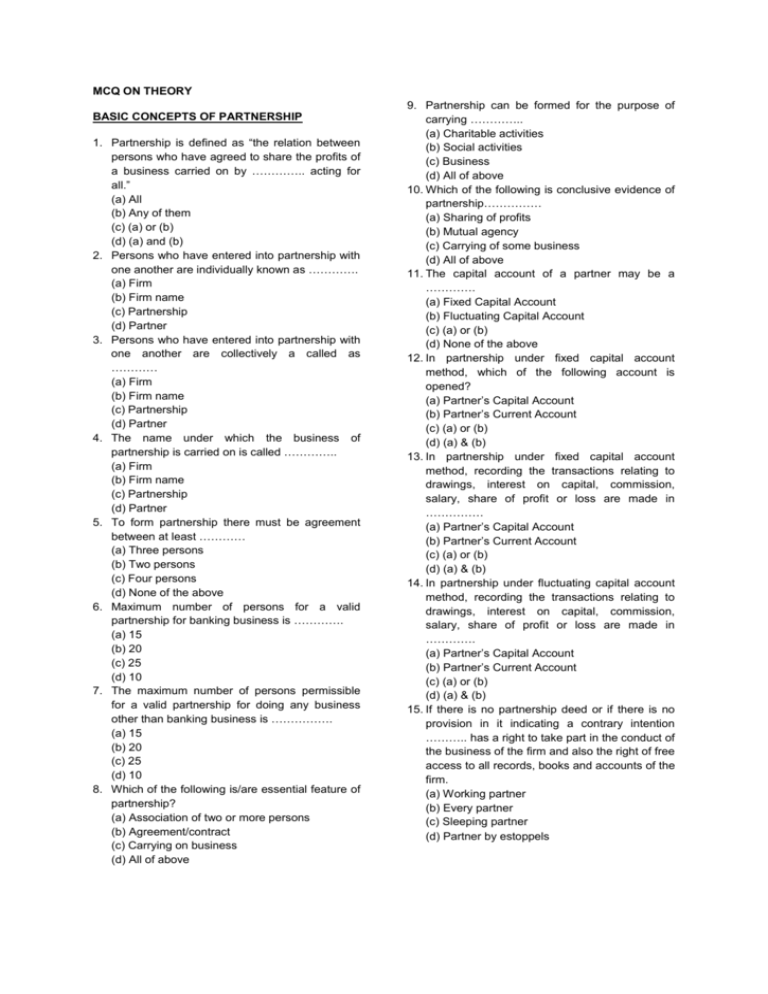

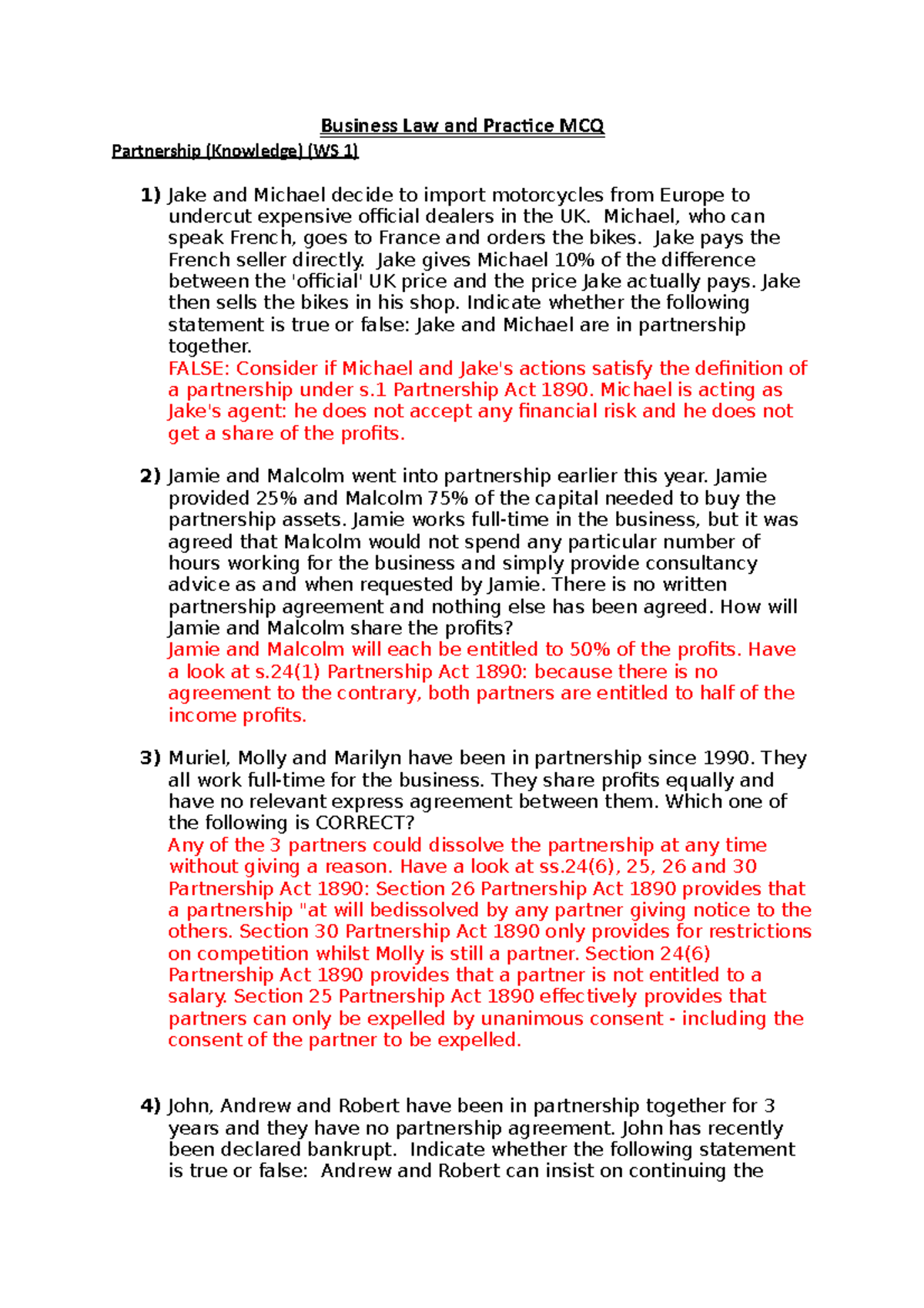

In the absence of partnership deed interest on loan of a partner is allowed mcq- Q33 On 1st January 19, a partner advanced a loan of Rs to the firm In the absence of agreement, interest on loan 31st march 19 will be a Nil b Rs 1500 c Rs 3000 d Rs 6000 Answer Rs 1500 Q34 Intangible assets (goodwill) has been defined in a AS 16 b AS c AS 26 d AS 21 Answer AS 26 Q35 Charulata is a partnerA partnership deed is an agreement between two or more individuals who sign a contract to start a profitable business together They agree to be the coowners, distribute responsibilities, income or losses for running a business In the Partnership deed, the partners are equally responsible for the debt of an organisation

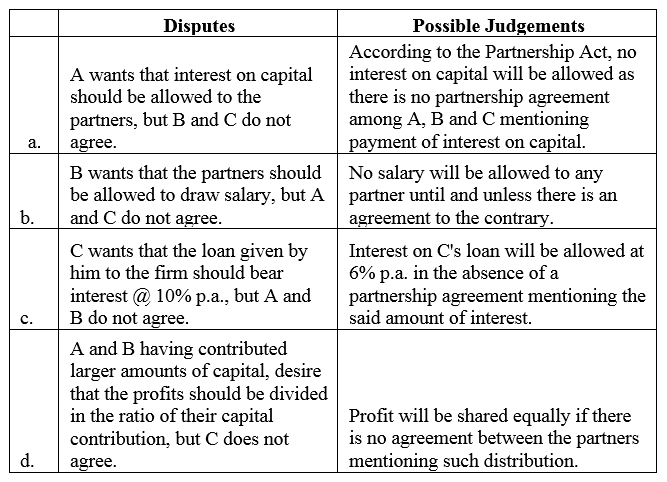

A B C Are Partners In A Firm They Have No Partnership Agreement For Their Guidance At The End Of The First Of The Commencement Of The Firm Sarthaks Econnect

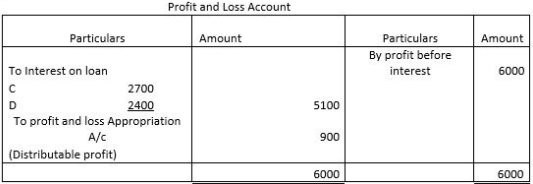

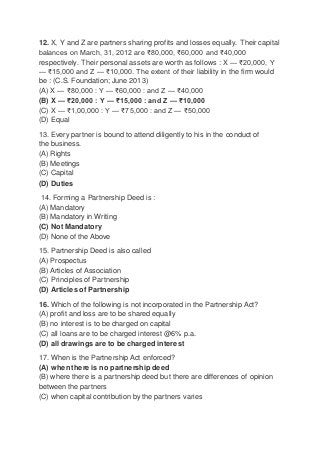

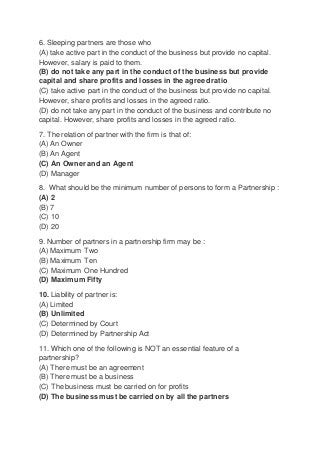

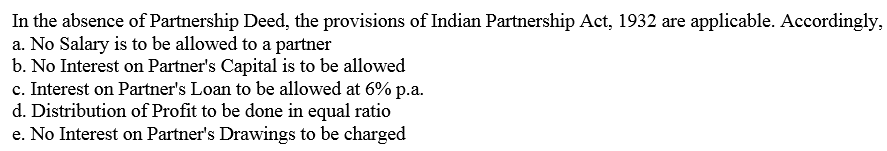

Answer As per the Indian Partnership Act 1932, the rules applicable in the absence of partnership deed are Interest on capital Interest on capital is not allowed to any partner In the absence of a partnership deed or verbal agreement, or if the partnership deed is silent on a certain point, various provisions of Partnership Act, 1932 will be applicable Question In the absence of Partnership Deed, interest on loan of a partner is allowed (a) at 8% per annum (b) at 6% per annum (c) no interest is allowed (d) at 12% In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm Answer Answer (c) Limited Liability Question 23 In the absence of partnership deed, interest on capital will be given to the partners at (b) 6% pa Basic Concepts MCQs Multiple Choice Questions with Answers, drop a comment

In the absence of Partnership Deed, the interest is allowed on the loan given by the partners to the firm— (a) 9% per annum (b) 8% per annum (c) 6% per annum (d) 5% per annum 5 In the absence of Partnership Deed, the interest is allowed on the capital of the partner— (a) No interest is allowedInterest at the rate of 6% is to be allowed on a partner's loan to the firm Solution In the absence of any agreement interest on advances by a partner is allowed at 6 percent pa and is allowed whether there is profit or no Interest on loan is a charge andIn the absence of partnership deed, interest on loan of a partner is allowed @8% per annum, @6% per annum, no interest is allowed, @12% per annum

In the absence of partnership deed interest on loan of a partner is allowed mcqのギャラリー

各画像をクリックすると、ダウンロードまたは拡大表示できます

|  |  |

|  |  |

|  |  |

「In the absence of partnership deed interest on loan of a partner is allowed mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |  |

|  | |

「In the absence of partnership deed interest on loan of a partner is allowed mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |  |

|  |  |

「In the absence of partnership deed interest on loan of a partner is allowed mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  |  |

「In the absence of partnership deed interest on loan of a partner is allowed mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  |  |

「In the absence of partnership deed interest on loan of a partner is allowed mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  |  |

「In the absence of partnership deed interest on loan of a partner is allowed mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  |  |

「In the absence of partnership deed interest on loan of a partner is allowed mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

| ||

「In the absence of partnership deed interest on loan of a partner is allowed mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |  |

|  | |

「In the absence of partnership deed interest on loan of a partner is allowed mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  |  |

「In the absence of partnership deed interest on loan of a partner is allowed mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  |  |

「In the absence of partnership deed interest on loan of a partner is allowed mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

|

A partnership firm earned divisible profit of Rs 5,00,000, interest on capital is to be provided to partner is Rs 3,00,000, interest on loan taken from partner is Rs 50,000 and profit sharing ratio of partners is 53 sequence the following in correct way I Distribute profits between partners II Charge interest on loan to Profit and Loss A In the absence of Partnership Deed , Interest on loan of a partner is allowed a) 8% per annum 2 In the absence of Partnership Deed Interest on Drawing of a partner is charged b) 9 % per annum c) 6% per annum d) No Interest is charged

Incoming Term: in the absence of partnership deed interest on loan of a partner is allowed mcq,

0 件のコメント:

コメントを投稿